Page 55 - July1998

P. 55

Julv 1998 NATIONA'I B{JlfllONEIJntElllN 191

National Button Society

Notos to Financial Statemsnts

December 31,1997

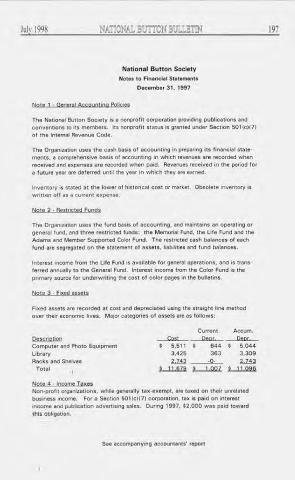

Note 1 - General Accounting Policies

The National Button Society is a nonprofit corporation providing publications and

conventions to its members. lts nonprofit status is granted under Section 501(c)(7)

of the lnternal Revenue Code

The Organization uses the cash basis of accounting in preparing its financial state-

ments, a comprehensive basis of accounting in which revenues are recorded when

received and expenses are recorded when paid. Revenues received in the period fot

a future year are deferred until the year in which they are earned.

Inventory is stated at the lower of historical cost or market. Obsolete inventory is

written off as a current expense.

The Organization uses the fund basis of accounting, and maintains an operating or

general fund, and ihree restricted funds: the Memorial Fund, the Life Fund and the

Adams and Member Supported Color Fund. The restricted cash balances of each

fund are segregated on the statement of assets, liabilities and fund balances.

Interest income from the Life Fund is available for general operations, and is trans-

ferred annually to the General Fund. Interest income from the Color Fund is the

primary source for underwriting the cost of color pages in the bulletins.

Note3-Fixedassets

Fixed assets are recorded at cost and depreciated using the straight line method

over their economic lives. Major categories of assets are as follows:

Current Accum-

Oescriotion Cost Deor. Deor.

Computer and Photo Equipment 9 5,511 $ 644 I 5,044

Library 3.425 363 3,309

Racks and Shelves 2.743 -O- 2.743

Total s_ll-€79 t____taoz _$__ll-o90

,

Non-profit organizations, while generally tax-exempt, are taxed on their unrelated

business income. For a Section 501 (c)(7) corporation, tax is paid on interest

income and publication advertising sales. During 1997, $2,OOO was paid toward

this obligation.

See accompanying accountants' reporl